Update to my @pendle_fi x @boros_fi trading series On the 5th we saw some wild spikes on rates. I took advantage here and exited my longs. - The move was super fast, looked like a few players were longing and causing the increase in price - Funding rates were flipping positive again but usually implied rates take a little while longer to price in, it just felt a little too fast for me - High 7's is good enough risk wise to exit or at least begin exiting. I personally felt better to just de-risk. Managed to take a screenshot below to show what my position looked like at the time. Fortunately I did close because this went all the way back down as funding rates went from -10%, to 10%, then back to -8% all within a couple hours. Since then prices have been up-trending slowly although I've been on the sidelines now sitting flat on ETH. If there is anything for me to trade atm, it'll be shorting BTC rates in the mid to high 7's. Until then I'll be waiting for a better trade...

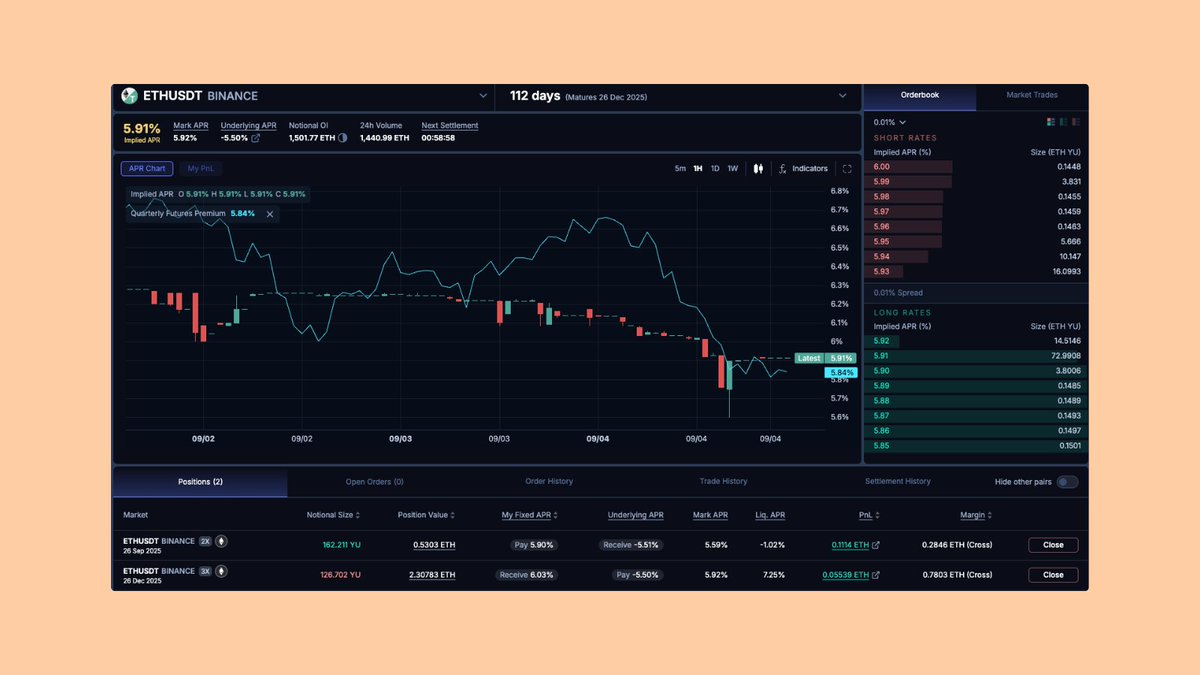

Made a mistake today Another update to my @pendle_fi trading series on @boros_fi I closed my short ETH rate and flipped long - I thought we're close to a bottom. Historically, funding doesn't go negative on ETH for long periods of time. - Down only on ETH had been too easy and I thought shorts would start closing in general, especially as implied rates hit 5-6% - Assuming some bounce back to the mid 6's, I thought I could hit a nice scalp with a reversion trade essentially even though I'm paying net funding to keep positions open What I didn't expect was Binance funding rates to go to -5% and even for a short time period, -10%. Had I kept my original ETH short, I would've continued to print so hard over the last couple days due to the funding spread. I then opened a short on the 2nd market since there was a spread in my favour and I expect that gap to close a bit with time + also hedges me a little until Binance funding normalises somewhat. That should explain why I have 2...

5.3K

19

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.