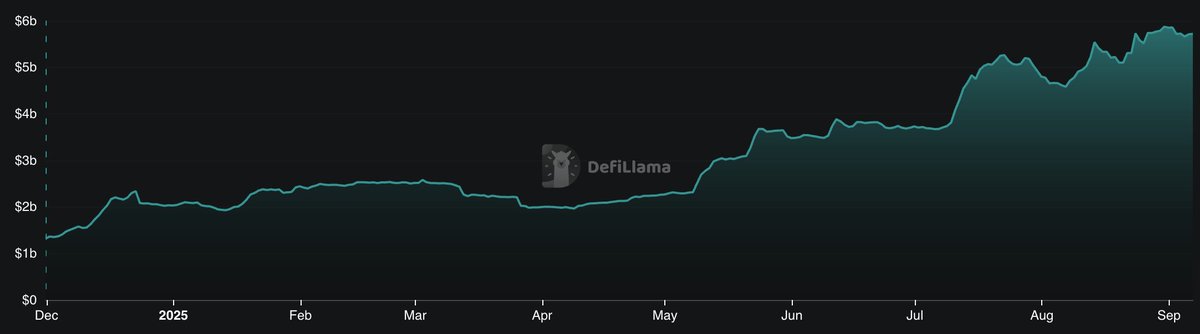

the USDH bidding wars are heating up 🍿 as @HyperliquidX plans to launch USDH, we're already seeing top contenders jockeying to win issuance and offering of up to 100% of reserve interest/revenue to go back to the Hyperliquid community. quick recap for those unfamiliar: - stablecoins are core to Hyperliquid's business model, like with any perp exchange. - there are currently $5.72b worth of stablecoins on the HyperEVM. ~95% of that is USDC. in other words, ~95% of stablecoin supply on Hyperliquid is freezable today. - it's clear this is as unsustainable as it is undesirable for Hyperliquid. the need for a Hyperliquid-native stablecoin has been talked about for a while now. - the cool thing is Hyperliquid is now letting its token holders vote on who will be the native issuer for USDH. so who's currently bidding? @Paxos - issue USDH as a fully regulated, GENIUS/ MiCA compliant stable with global banking rails and fiat on/off-ramps. - allocate 95% of interest from reserves...

Show original

13.21K

81

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.