Recently, we launched a new leaderboard project, and I take a stroll through it 🚶. Later, I will provide everyone with a quicker overview research.

Let’s learn about the RWA Layer 1 project for real estate tokenization in Dubai.

"Bridge beans, my baby, is this the Jucoin Dubai institutional version?" (Not alpha, just discussing @MavrykNetwork)

1⃣️ Team Background

Alex and Sam have a senior-junior relationship, with Sam providing technical support.

In 2022, Alex started his own company, Mavryk Dynamics, after having a couple of years of industry experience and resources in the Middle East and North Africa. For the past two years, they have mainly been working on Maven Finance, a DeFi product. It now seems they are primarily promoting Mavryk Network, an L1 narrative for RWA and DeFi. They are all projects under the same company.

Their LinkedIn shows they studied in Israel and are based in Dubai, so they should be a team from Dubai or the Middle East, but their specific capabilities are still unknown.

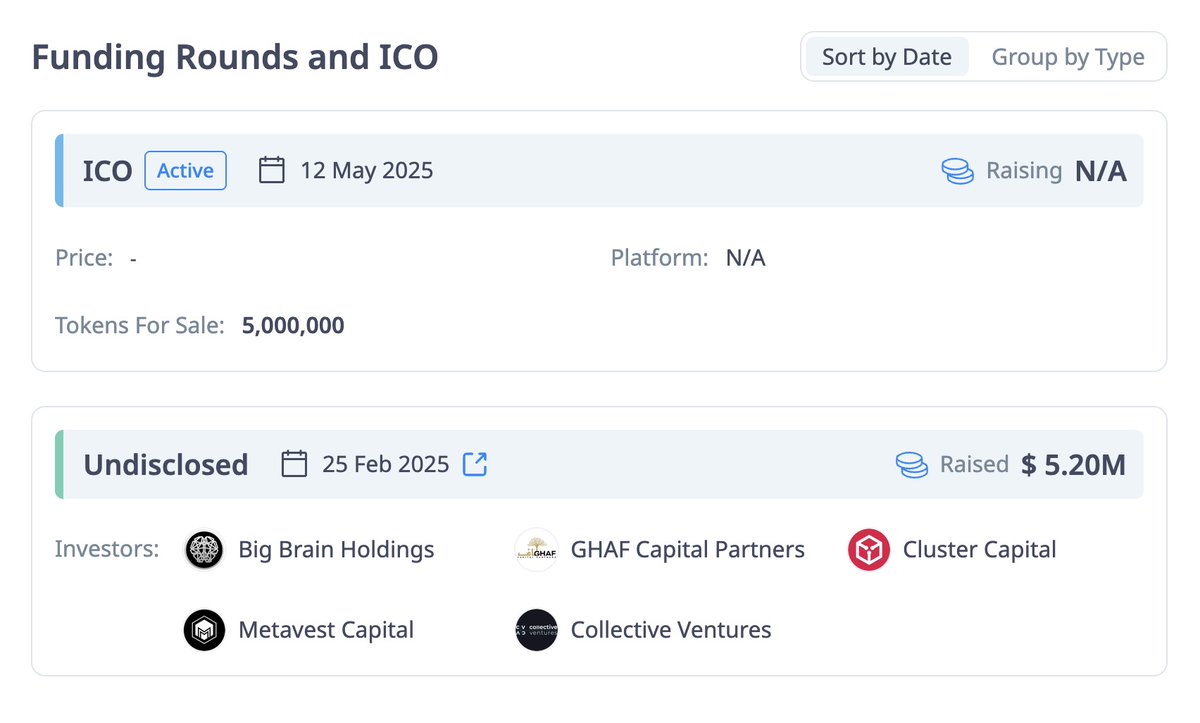

2⃣️ Financing Situation

Currently, they have raised a total of 5.2M, but I don’t know where the ICO rounds are. The VCs are tier 3-4, coming from the US, Dubai, Australia, South Africa, and Germany, but I haven’t seen anything significant here yet.

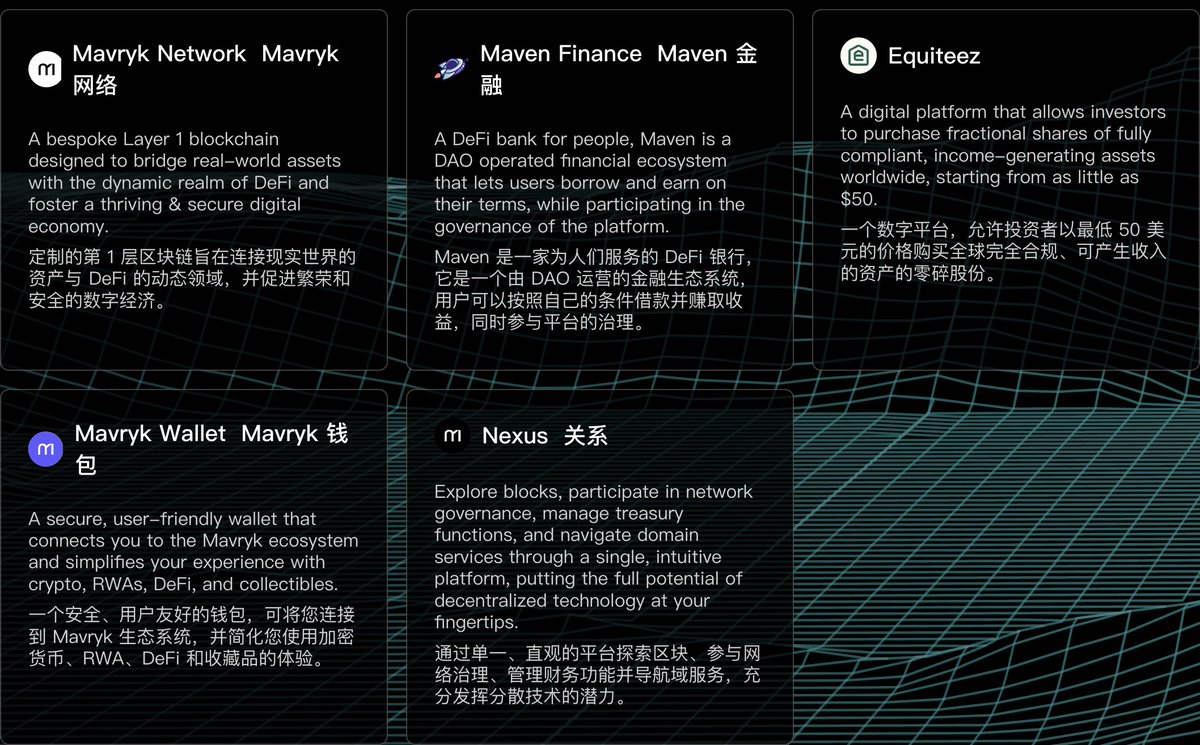

3⃣️ Back to Fundamentals, Products, and Resources

This is the business scope of Mavryk Dynamics, including lending, trading, wallets, etc. (I’m a bit lazy to look into it right now; basically, it’s just a financial gene, so let’s refocus on Mavryk Network).

This tokenization plan centers around high-end real estate from MAG Lifestyle Development, including assets like the Ritz-Carlton apartments and Keturah Reserve. These properties are going live as a trading and issuance platform for investors.

Mavryk's blockchain infrastructure is responsible for issuing these tokenized assets. Fireblocks has introduced a custody layer, providing wallets based on MPC (Multi-Party Computation) without the need for private key management. This allows institutions to use the tools and systems they already employ for digital assets like stablecoins or tokenized treasury bills to interact with tokenized assets.

Related assets are in processing, with the real estate valuations entering the system exceeding $10 billion.

The process begins with users depositing USDT (Tether) from their MultiBank spot wallet into a dedicated RWA wallet supported by Fireblocks. After that, users can purchase tokenized real estate assets natively issued on the Mavryk blockchain. These assets fully comply with KYC requirements and integrate jurisdictional controls and real-time settlement features.

In this model, Fireblocks is responsible for wallet-level security and asset custody, while Mavryk handles the support for issuance and trading logic, providing user interfaces, market access, and regulatory compliance layers. This layered structure is similar to traditional financial infrastructure, only it’s on-chain.

This integration also brings RWA tokens into the ecosystem of over 2,000 institutional clients of Fireblocks, meaning distribution is no longer just theoretical. The infrastructure is already in use.

For Mavryk, this marks its entry into the high-end ranks of RWA infrastructure providers. For Fireblocks, it adds real estate to its supported asset classes. And for investors, it allows seamless access to a compliant, stable asset-backed token environment.

Bridge beans, my baby, is this the Jucoin Dubai institutional version?

Show original

2.05K

19

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.