HODL $BTC

Keep building BTC Dapps

Bring prosperity to $Bitcoin

#Odinfun #Babyodin #RADFI

Bitcoin DeFi: The Most Asymmetric Opportunity in All of Crypto

A heavily requested deep dive by yours truly.

(disclaimer, not a single AI model was used in the creation of this post)

Bitcoin Dominance

If you stop and think about it, it is obvious.

1. Bitcoin is 60% of the total crypto market cap

2. Bitcoin is the world’s most decentralized, secure blockchain on planet earth

3. 90% of the world has heard about Bitcoin

4. Bitcoin has favorable regulatory standing (ETF, institutional adoption)

If you can build something on Bitcoin, there is no reason to build it anywhere else.

With the recent developments in the Bitcoin Season 2 scene (BitVM, CatVM, statechains, account abstraction, chain abstraction, sidechains, better UX, CAT / CTV / CSFS) I am extremely confident when I say:

“Anything that has ever been done anywhere on any chain is coming to Bitcoin”

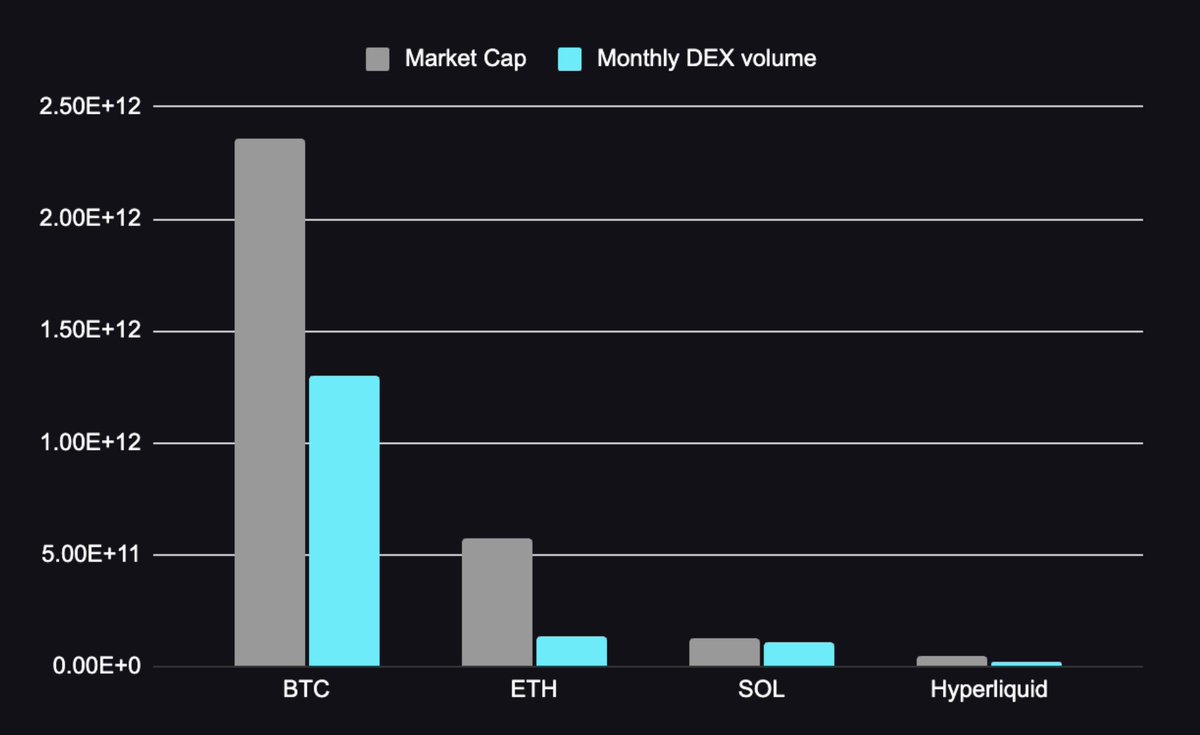

Monthly DEX Volume / Market Cap

If you compare the monthly DEX volumes of Ethereum, Solana, and Hyperliquid to their market caps you get an average of 55% (SOL, HYPE a bit higher, ETH a bit lower).

This means that ETH, SOL, and HYPE DEXs do 55% of their market cap in monthly DEX volume (on average).

If we apply this same ratio to the Bitcoin market cap, we get $1.3T in monthly DEX volume… which is staggering. This number is massive. That is $1,300,000,000,000. The revenue on that volume at 0.1% would be $1.3B every month.

While this number seems big, it actually isn’t THAT big. For comparison, if you add up monthly trading volume (in US dollars) for the NYSE + Nasdaq + Gold and Silver futures you get about $3T / month. So even when Bitcoin DeFi gets to $1.3T / month in trading volume, it will still only be 30% of everything I just listed added together.

A Bitcoin Denominated Future

In a Bitcoin denominated future, or honestly even in just a “federal reserve keeps printing dollars” future, a few things are certain:

1. Inflation will continue to erode our trust and our savings

2. We will continue to seek stores of value as a hedge against inflation

3. We will continue to devalue inflating assets (and increasingly so over time)

4. We will start to want to price things in BTC rather than USD

5. We will want to trade in Bitcoin denominated markets rather than USD denominated markets

I don’t know about you, but Bitcoin denominated markets sound an awful lot like Bitcoin DEXs to me.

And when you think about it this way, the road to $1T monthly Bitcoin DEX volume doesn’t actually seem crazy at all. It is inevitable.

Looking Forward

We are deeply committed to this vision

We’re in this for the long haul

We’re just getting started

We have so many more places to go

I can say it a million different ways, but the words just don’t do it justice. So look at our actions instead.

We will work harder for our users than any other team out there. If you don’t believe this then go back 3 weeks and look at what we went through to be here right now.

This opportunity is massive and we are excited to be a part of it. Bitcoin DeFi will be HUGE. Perhaps the greatest blue ocean market in the world.

Bitcoin DeFi truly is the most asymmetric opportunity in all of crypto.

1.77K

1

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.